The UK grain market in 2025: arable margins under pressure

3-MINUTE READ

This has been another challenging year for UK arable farming. Against a backdrop of inflation, rising input costs and prolonged uncertainty around agricultural support, consistently low grain prices have placed farm profitability under sustained pressure.

Defra’s latest Farm Business Income report indicated that 27% of UK arable farms ran at an overall loss in 2024/25, and the average loss on grain production itself was £27,400 per farm. Only diversification, agri-environment schemes and the BPS are keeping most arable businesses afloat.

The implications for the UK’s food self-sufficiency are clear: if arable farming is unprofitable, why should UK farmers maintain sufficient levels of grain production? Yet one of the most striking themes of 2025 has been the growing disconnect between the prices farmers receive for their grain and the prices consumers pay for food.

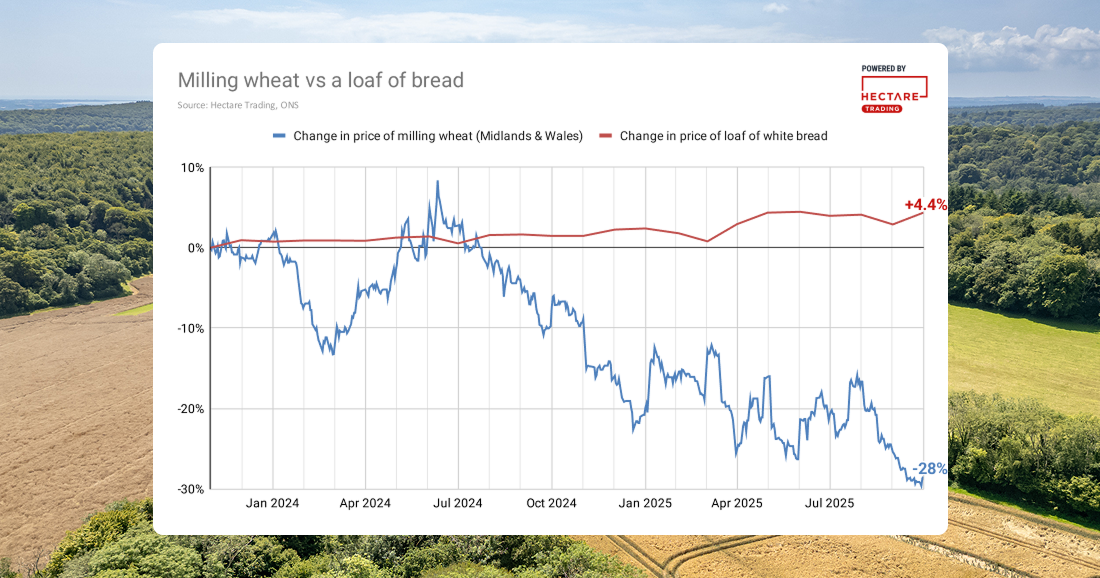

Back in June, we looked at the erosion of milling premiums, and this downtrend has only continued. In fact, since November 2023, milling wheat prices in the Midlands & Wales have fallen by 28% while, over the same period, the average price of a loaf of white bread has risen by 4.4%, according to UK RPI data.

Milling wheat prices have fallen 28% since November 2023 while the price of a loaf of bread has risen by 4.4%

Feed wheat: regional dynamics in a low market

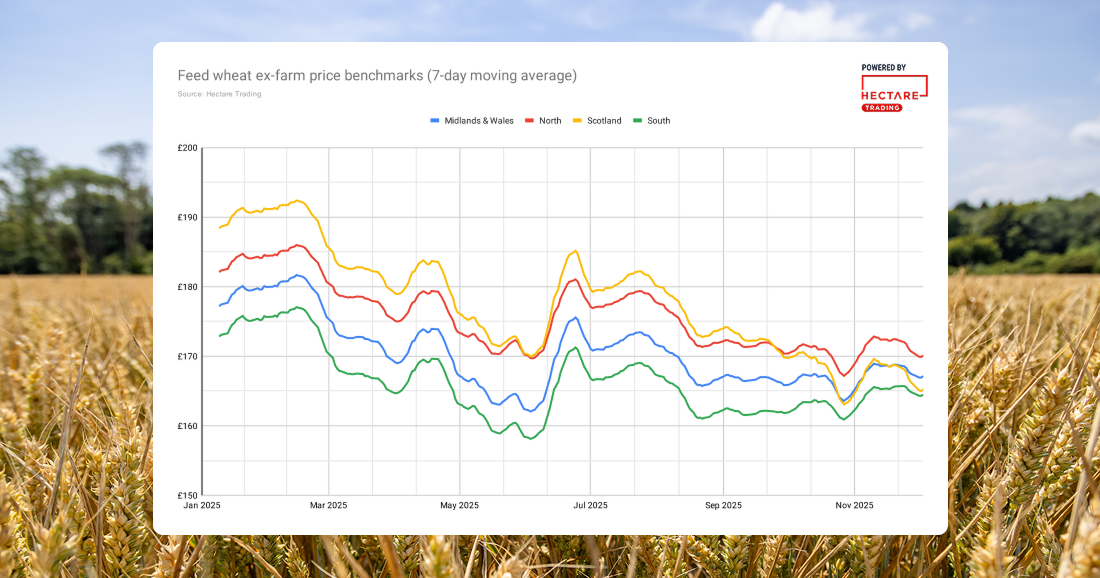

Our crop price benchmarks at Hectare Trading have been under pressure throughout 2025, across all UK regions.

Spot ex-farm feed wheat prices fell to their lowest levels of the year in May, dipping to around £157/t in the South. While there was a brief lift during harvest, prices failed to hold, drifting lower again into the autumn.

Values in Scotland were notably weak in recent months compared with other UK regions, which points to a key feature of 2025, that national benchmarks have not always reflected the realities of local supply and demand. Regional basis movements can still create pockets of opportunity for grain sellers, even while global and national markets are weighed down by ample supply.

Spot ex-farm feed wheat moving averages in 2025 for the UK regions, based on sales on Hectare Trading

For many farmers, 2025 was not defined by a single shock, but by the persistence of unfavourable conditions. Variable yields compounded the problem, leaving little margin for error in an already tight year.

Faced with such low prices and limited confidence in market recovery, many farmers approached grain marketing cautiously in 2025. Pre-harvest forward-selling was relatively subdued, as growers were reluctant to commit tonnage at values that barely covered costs.

However, once harvest passed and prices showed little sign of improvement, selling strategies began to evolve. More farmers turned to forward-selling post-harvest, seeking to take advantage of carry in the market rather than wait indefinitely for a rally that might never come.

OSR: improved conditions prompt more planting

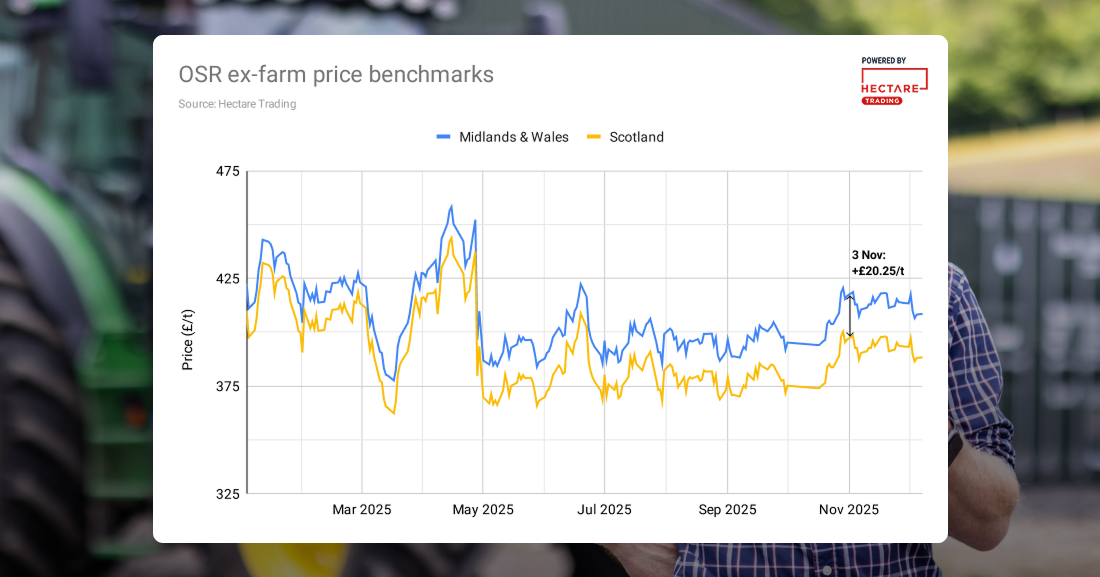

Not all markets struggled equally. Oilseed rape stood out as one of the few areas of relative strength in 2025. Improved yields and increased production coincided with prices that held up well through much of the year, hitting a high of £458.12/t on 15 May in the Midlands & Wales.

Growers in the Midlands also benefited from a strengthening regional basis over Scotland, the premium hitting £20.25/t on 3 November, further evidence of the shift in regional dynamics through the year.

Our spot ex-farm OSR price benchmarks in the Midlands & Wales and Scotland, throughout 2025

This more favourable market has already influenced planting decisions, with a 30% increase in OSR planting intentions for harvest 2026.

However, this success also carries a warning. Greater production next year may place downward pressure on prices, reinforcing the importance of forward-selling and early risk management while margins remain attractive.

Looking ahead to 2026

Persistently low prices and rising costs have exposed the vulnerability of arable margins. Under this relentless pressure, how can UK arable farmers survive the profitability squeeze?

The past year has shown that, in low-price environments, marketing decisions can be just as critical as agronomy in determining overall profitability. In particular, we have seen the importance of:

Strategic selling

Forward contracts can help you to lock in prices early and manage market risk

Regional market insight

See when limited supply in your region may boost prices above market averages

Data-driven decision-making

Track the market day by day to improve the timing of your grain sales

As we move into 2026, relying on market recovery alone is no longer a viable strategy. In a sector facing significant structural pressures, protecting margins will increasingly depend on proactive grain marketing, broader access to buyers and better market information.

With improved visibility of local markets and a more strategic approach to selling, UK arable farmers can build resilience in the year ahead.

Check out our live view of the grain market on Hectare Trading and post your own free crop listing for immediate or future movement.

This article is for general information only and is not an instruction to trade. While we make every effort to ensure the accuracy of the content at the time of publication, Hectare Trading makes no guarantee regarding the data provided.