Harvest 2025 underway while global grain supply tightens

3-MINUTE READ

The UK’s 2025 harvest is off to a brisk start, with some encouraging early signs for winter barley growers. But how will changes in global supply affect grain prices?

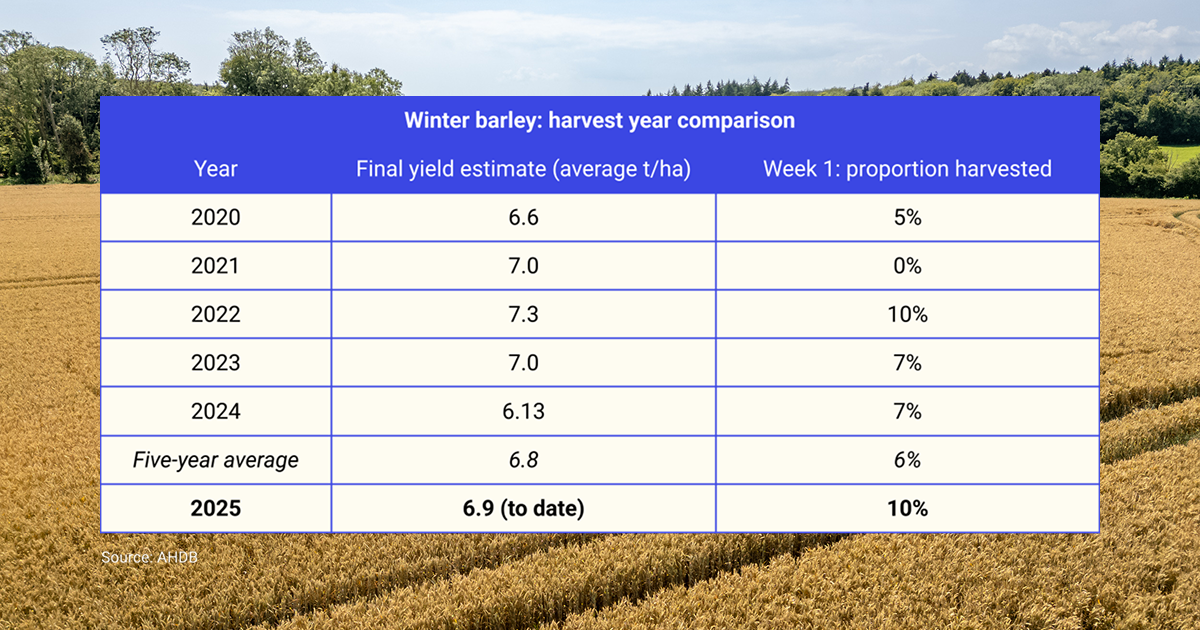

According to AHDB’s first harvest progress report of the season, 10% of the UK’s winter barley had been cut by 9 July. That’s well ahead of the five-year average of 6% for this stage of the harvest, helped along by the dry spring.

However, many combines were parked up again as heavy rain swept across much of the country on 5 and 6 July.

The winter barley harvest is ahead of the five-year average, with an encouraging early yield estimate

While our own Hectare Trading harvest progress report shows some early cutting underway in the North and the Midlands, AHDB’s figures so far only show significant progress in the East of England, where 38% of winter barley is in the shed, and the South East, which is 19% complete.

If the weather obliges, many growers will be hoping to get winter barley cleared over the next fortnight and make a solid start on oilseed rape and winter wheat.

Promising yields after reduced planting

The first yield estimate from AHDB for winter barley stands at 6.9 tonnes per hectare – about 2% above the five-year average of 6.8 t/ha and much better than last year’s 6.13 t/ha.

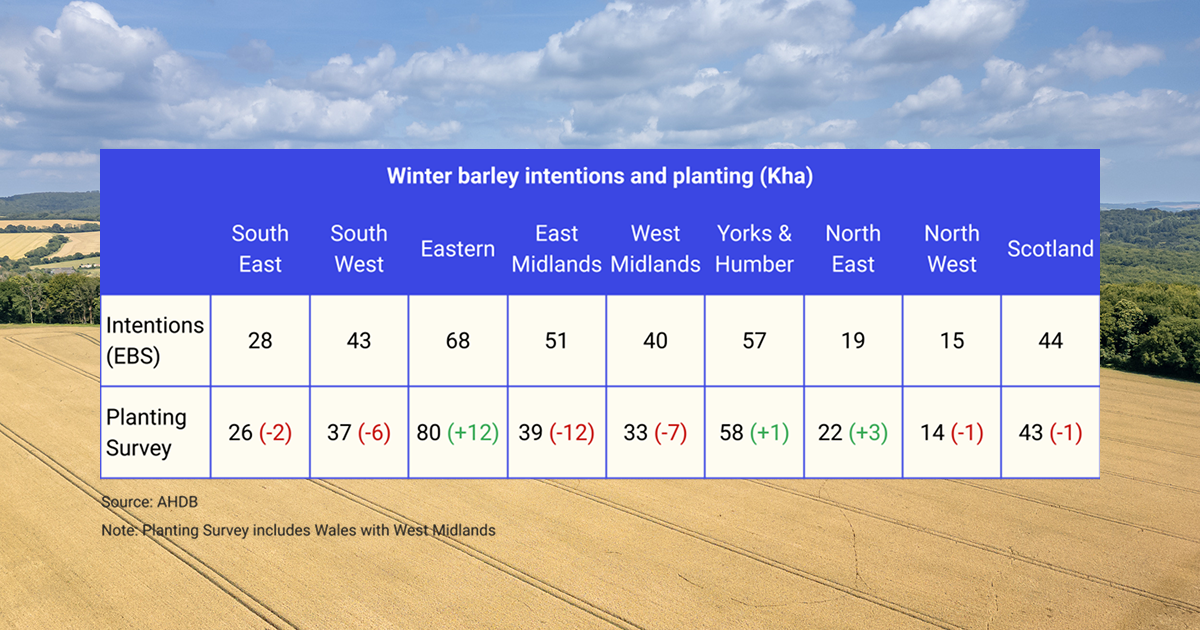

Yields will be especially significant as planting of winter barley reduced this season for the second year running. AHDB’s 2025 Planting and Variety Survey put the cropped area for Great Britain at 352,000 hectares. This was down 7% on last year, which was itself 11% down on 2023.

Planting of winter barley for 2025 was lower than intended in several regions

Persistent wet weather last September made drilling tricky across much of England and Wales, with many growers unable to stick to their original cropping intentions as reported in AHDB’s Early Bird Survey.

With this smaller area, good yields and sound grain quality will be essential to meet the demands of the UK’s brewers and distillers for malting barley.

The global picture

Meanwhile, it’s not just UK growers who are watching supply and demand closely. The latest WASDE report, published last Friday by the USDA, trimmed forecasts for global wheat ending stocks for 2025/26 by over a million tonnes, down to 261.52 million tonnes.

Reduced wheat production in Canada and Ukraine contributed to this tightening picture. The projection for US wheat ending stocks also edged down slightly, from 24.45 Mt to 24.23 Mt.

While the US harvest has been in progress for over a month now, cutting of winter wheat slowed a little last week. The latest USDA Crop Progress Report shows that 63% of winter wheat has been harvested across the US, down from 70% a year ago.

In particular, Colorado (47% complete against 72% last year) and Nebraska (35% complete against 64% last year) are struggling to catch up after rainy weather held up the wheat harvest in early July.

USDA figures also show that 82% of US winter wheat is rated in fair condition or above, an improvement from 79% in early April when ongoing dry weather raised crop quality concerns.

Manage uncertainty with strategic selling

With winter barley potentially in short supply, UK brewers and distillers may be looking to import. AHDB’s latest supply and demand estimates suggest that UK barley imports will hit 175,000 tonnes in 2024/25, well above the five-year average of 108,000 tonnes.

Meanwhile, the tighter global wheat outlook has seen UK feed wheat (November 2025) rise £3.50/t to £178.75/t and Paris milling wheat (September 2025) gain €4.75/t to €199.75/t since the end of June. But volatility is possible if the weather or geopolitical events throw up any surprises.

As ever, managing risk with timely selling and movement plans will be key. Despite lower prices, some selling at harvest could help protect your long-term profitability.

Need help getting started with Hectare Trading? Contact our team to see how to sell your crop and check real-time grain prices.

This article is for general information only and is not an instruction to trade. While we make every effort to ensure the accuracy of the content at the time of publication, Hectare Trading makes no guarantee regarding the data provided.