How to measure carry against your storage costs

3-MINUTE READ

Selling your crop forward can be a good option when prices are low to take advantage of the “carry”, the difference between the price for immediate movement and the price for future movement. But how can you work out whether the carry is enough to cover your extra costs for holding on to your crop?

The hard work is done and your crop is in the shed. Now ask yourself: is the market paying you to keep it there or to move it right away? To know this, you have to drill into the carry per month and your storage costs per month.

Measuring carry

Carry per month is simply the premium (if there is one) for a given future month over the spot price, divided by the number of months until delivery.

The enhanced Insights panel on Hectare Trading shows you the carry per month on a range of contract months for the UK (ICE) Feed Wheat futures. You can quickly see where the best carry per month applies and how this compares to average carry levels.

This analysis only applies to feed wheat – where relevant UK futures contracts are available – and doesn’t take account of regional variations.

To make this more personal to your own situation, compare prices currently offered for your crop in your region for immediate delivery with prices offered for future movement months. You can also access this information on Hectare Trading by listing your crop.

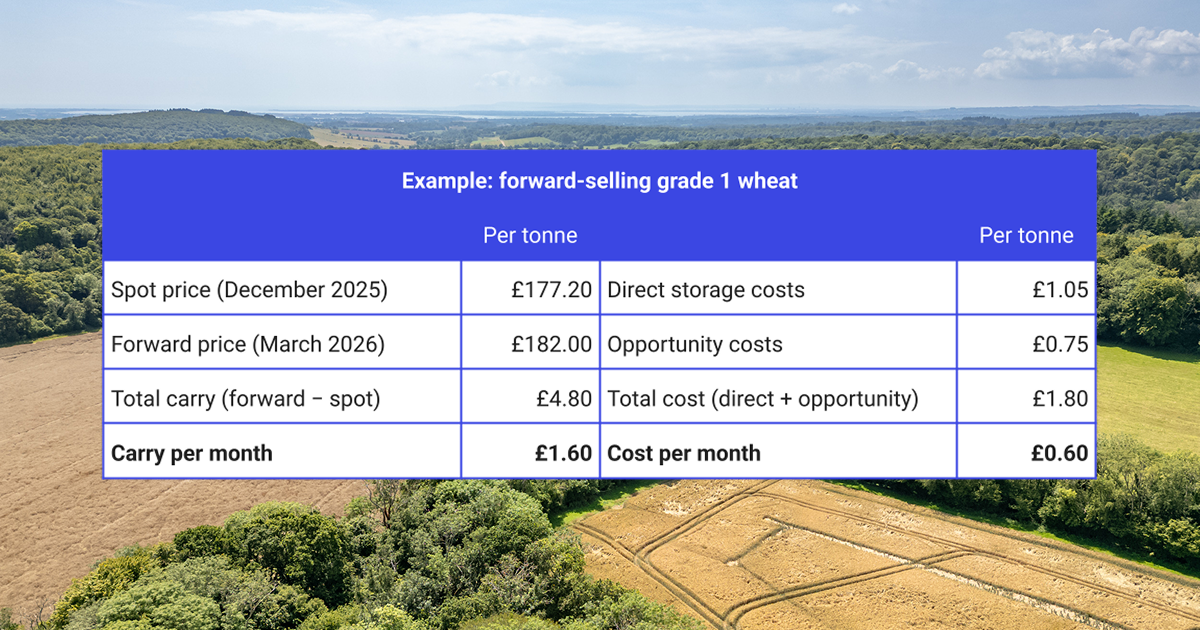

For example, say you have grade 1 milling wheat to sell in North Yorkshire, and the current spot price in your region is £177.20/t. You list your crop on Hectare Trading and get prices for a range of months, including an offer of £182.00/t for March 2026.

That’s a total carry of £4.80/t which breaks down as £1.60/t per month. Now find out how this stacks up against your costs.

Direct storage costs

Some of your costs for holding grain are immediately apparent. These include:

Drying and conditioning

Handling and turning

Ventilation, pest control and maintenance

Store depreciation and repairs

If you’re storing your grain off-farm, these costs will be paid to a third party. But whether you pay the costs yourself or via a commercial facility, you should be able to calculate a fixed cost per tonne for your stored crop each month.

Opportunity costs

Other costs can be less obvious. For example, could the cash tied up in your stored grain have been put to better use elsewhere?

Calculate your “cost of capital” per month including:

The interest on any debt you could have paid off if you weren’t paying for storage

The income you could have received from interest in a savings account or capital appreciation if you had invested the money instead of paying for storage

Also ask yourself: could I have made any other income from my storage if I wasn’t using it myself, for example by renting it out? This is another opportunity cost of holding grain.

Calculating these direct and opportunity costs gives you the minimum return your stored grain needs to generate – over and above what you could achieve by selling it at the spot price – to justify holding it.

Putting it all together

To return to our previous example, you now need to work out whether your cost for storing your grade 1 wheat is more or less than £1.60/t.

Say your direct costs to store your grain till next March come to £1.05/t. You also calculate that your lost income from holding your crop rather than selling it for immediate delivery comes to £0.75/t.

Compare the market carry to the cost for holding your grain, both broken down per month

Your total cost to store your grain therefore comes to £1.80/t, which breaks down as £0.60/t per month. In this example, you can make an extra £1/t per month for selling your grain forward.

Of course, this is just an example and storage costs can vary widely depending on your size of farm and set-up. But the more detail you can provide, the better understanding you have of your potential profit.

By expressing both the carry and your total storage costs in pounds per tonne per month, you can make a clear, confident decision based on your own numbers rather than averages or guesses, and find out when the market is paying you more than it costs to hold on to your crop.

Find out how much buyers in your region are currently paying for forward movement. Check the new insights on Hectare Trading or post your own free crop listing.

This article is for general information only and is not an instruction to trade. While we make every effort to ensure the accuracy of the content at the time of publication, Hectare Trading makes no guarantee regarding the data provided.