Hunting value: how to spot regional pockets of demand in a weak grain market

2-MINUTE READ

UK grain prices continue to struggle, weighed down by high supply at national and international levels. But there may still be tactical opportunities to achieve more value for your crop. The key is to look closer to home and pay attention to regional pockets of demand.

Hectare Trading’s regional price analysis shows that local dynamics can diverge sharply from national averages. Knowing where those differences lie can make all the difference to your grain marketing.

A switch in regional feed barley premiums

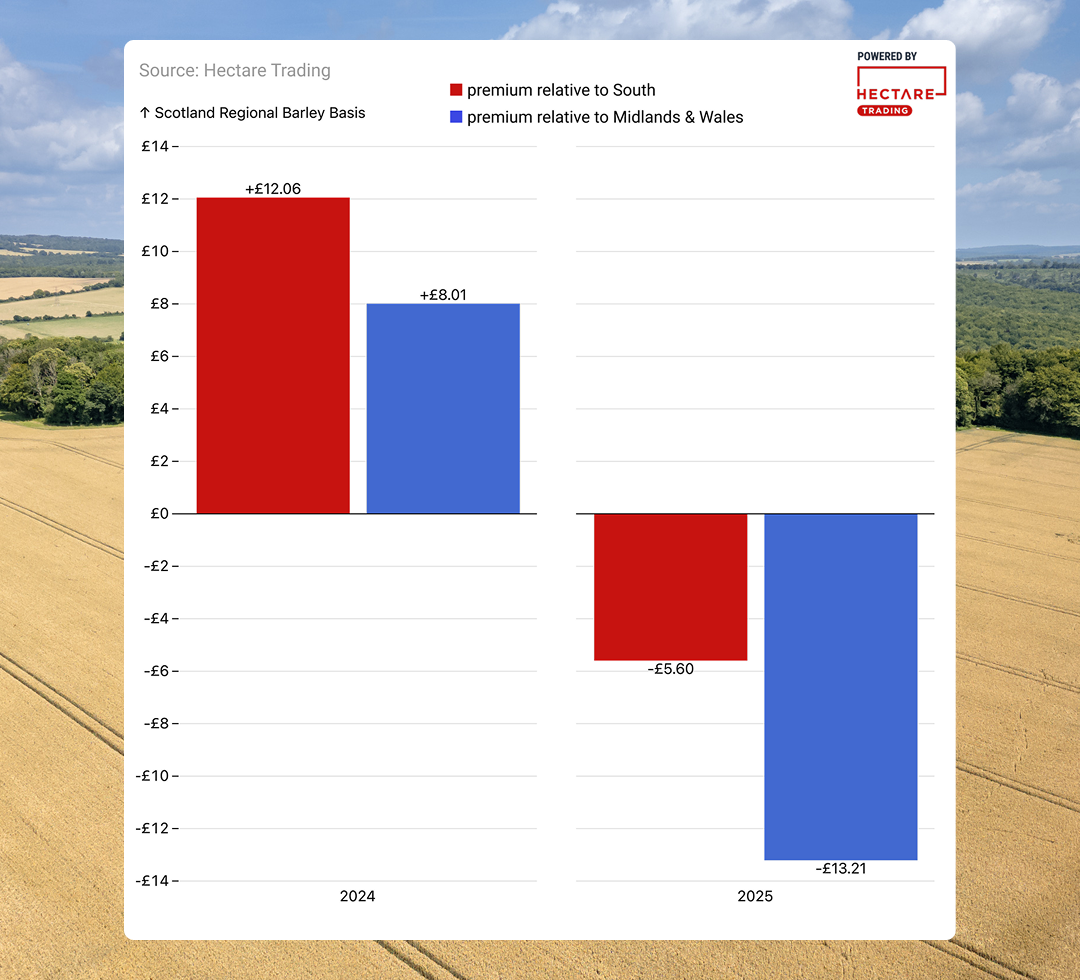

Scotland traditionally trades feed barley at a premium over other regions of the UK. In 2024, from July to September, Scottish farmers could sell feed barley for £12/t more than their counterparts in the South, and £8/t more than the Midlands & Wales.

But 2025 has turned the tables. A combination of weaker demand for malting barley and small grain size in the Scottish spring crop has forced more malting varieties into the feed market, causing oversupply in Scotland.

This means other regions now have a premium over Scotland. The South has averaged £5.60/t higher than Scotland on Hectare Trading during the same period this year, while the Midlands & Wales has achieved a striking £13.21/t more than Scotland.

The premium for feed barley in Scotland has reversed this year against the South and the Midlands & Wales

For more on the shifting regional dynamics of the UK grain market, plus the rise of forward-selling to lock in value, see this recent Farmers Guide feature based on Hectare Trading data.

Midlands feed wheat: ahead of the curve

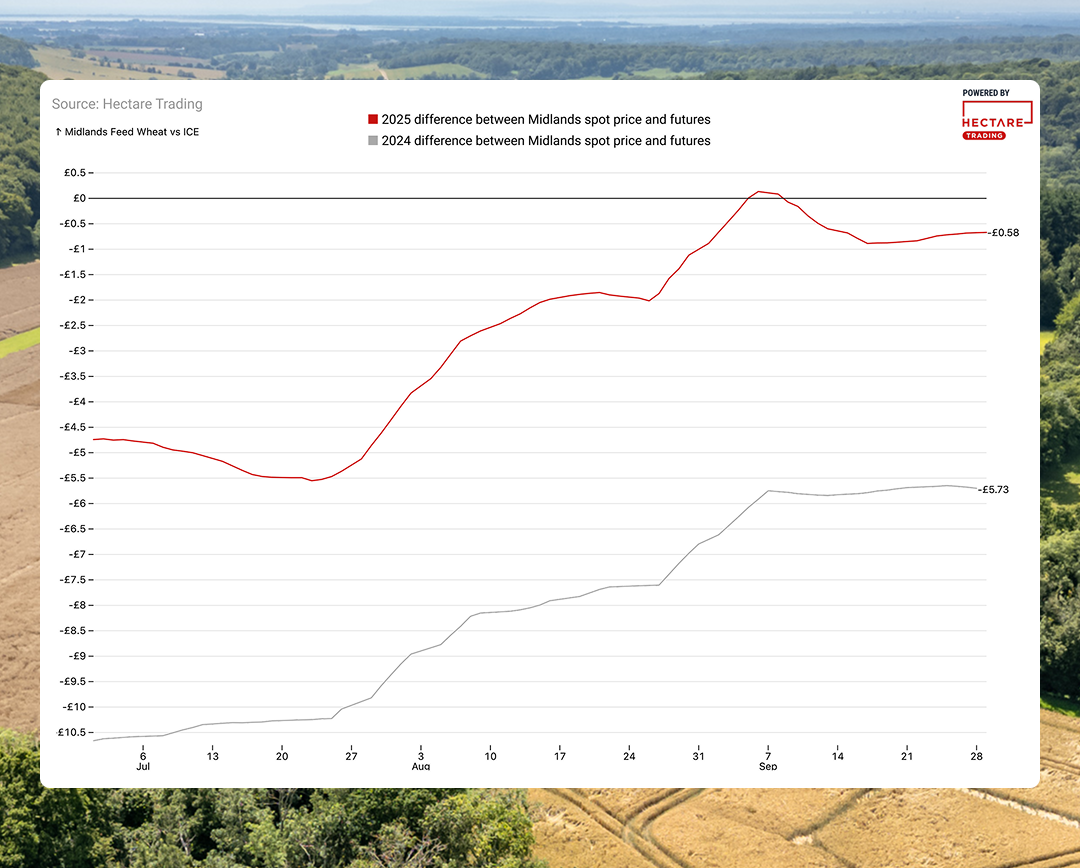

After a short rally in July to £180/t, the November UK Feed Wheat futures contract weakened to fall below £166/t on 22 September.

Typically, ex-farm spot prices for feed wheat in the Midlands lag behind futures prices through the second half of the year, catching up around the expiry of the November contract.

This year, however, Midlands spot prices reached parity with futures by early September – much earlier than in 2024. Tracking the seven-day moving average of the gap between spot and futures prices, we can see that feed wheat in the Midlands has stayed much closer to the futures in 2025.

The gap between spot and futures prices for feed wheat in the Midlands is much closer this year

For farmers in the region, it’s a sign that local demand has been supporting prices, even as futures markets have come under pressure.

North vs Scotland: a reversal in feed wheat demand

The AHDB Corn Returns for Scotland have been quite infrequent this year, making it hard to track regional variations. Instead, we can look at average prices on Hectare Trading to pick out another regional shift in demand.

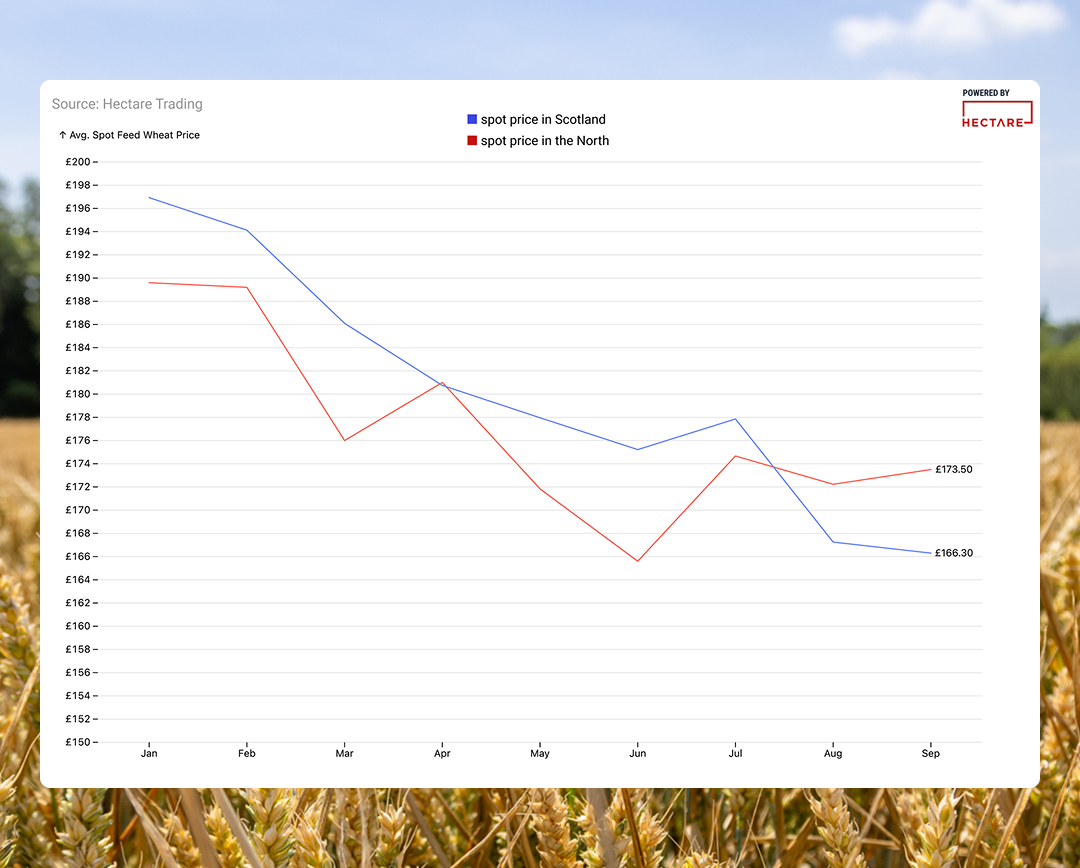

For the first three months of 2025, Scotland commanded a £5/t premium over the North for feed wheat. The average ex-farm spot price for feed wheat on Hectare Trading was £188.18/t in the North compared to £193.50 in Scotland.

In the last three months, the picture has reversed, with the North averaging £172.74/t compared to just £169.01 in Scotland. This swing of over £9 in the premium highlights just how quickly regional demand can change.

A full breakdown by month shows the shift in detail over the year. While feed wheat prices have trended downward, demand in the North relative to Scotland has improved. The average spot price in September stood at £173.50/t in the North and only £166.30/t in Scotland.

Monthly average ex-farm spot price for feed wheat, Scotland versus the North

Finding value in local markets

Futures charts and AHDB Corn Returns are blunt instruments for tracking regional demand. The real insight comes from looking at comparative values in local markets.

By following regional ex-farm spot prices on Hectare Trading, you can see where demand is strongest and make more informed selling decisions. Set price alerts for your preferred crops and regions and you’ll be notified whenever local demand strengthens.

And if you want to test your local market directly, you can always post a listing – with no obligation to accept any offer.

As we’ve seen, local shifts in demand can quickly turn a regional premium into a discount – or vice versa. Being ready to act on those signals is an essential part of smart grain marketing.

Give buyers the chance to show you what they’re willing to pay. Offering your crop for sale is quick and easy on Hectare Trading – and absolutely free to farmers.

This article is for general information only and is not an instruction to trade. While we make every effort to ensure the accuracy of the content at the time of publication, Hectare Trading makes no guarantee regarding the data provided.