Going global: why it pays to watch international harvests

3-MINUTE READ

At harvest time, it’s natural to have your eyes firmly fixed on the combine, the skies overhead and your own yield and crop quality. But when it comes to the price you’ll get for that crop, there’s a much bigger picture to consider.

Global grain markets are a complex web, and there are many international economic and geopolitical factors affecting the price of your grain:

Exchange rates

If the pound is weak against the US dollar and the euro, UK grain is cheaper for overseas buyers. This can increase demand and lift domestic prices. Conversely, if sterling strengthens, UK grain becomes relatively more expensive, and demand can dip. We’ve seen this with the consistent gains the pound has made against the dollar so far this year.Interest rates

Higher interest rates, either at home or in major international markets, can slow economic growth and reduce demand for grain. Buyers may take a more cautious approach when economic confidence is low.Government policies

Just as UK arable farmers are dependent on specific government decisions, so global grain markets are influenced by trade deals, subsidies and environmental regulations effective in different regions.

International conflicts

Global grain supply and demand can of course be more drastically affected by war, sanctions and trade disputes, having a direct impact on UK grain prices.

Harvest timing around the world

Even if you’re only selling your grain domestically, one of the biggest factors influencing UK prices is when and how much grain hits the market around the world.

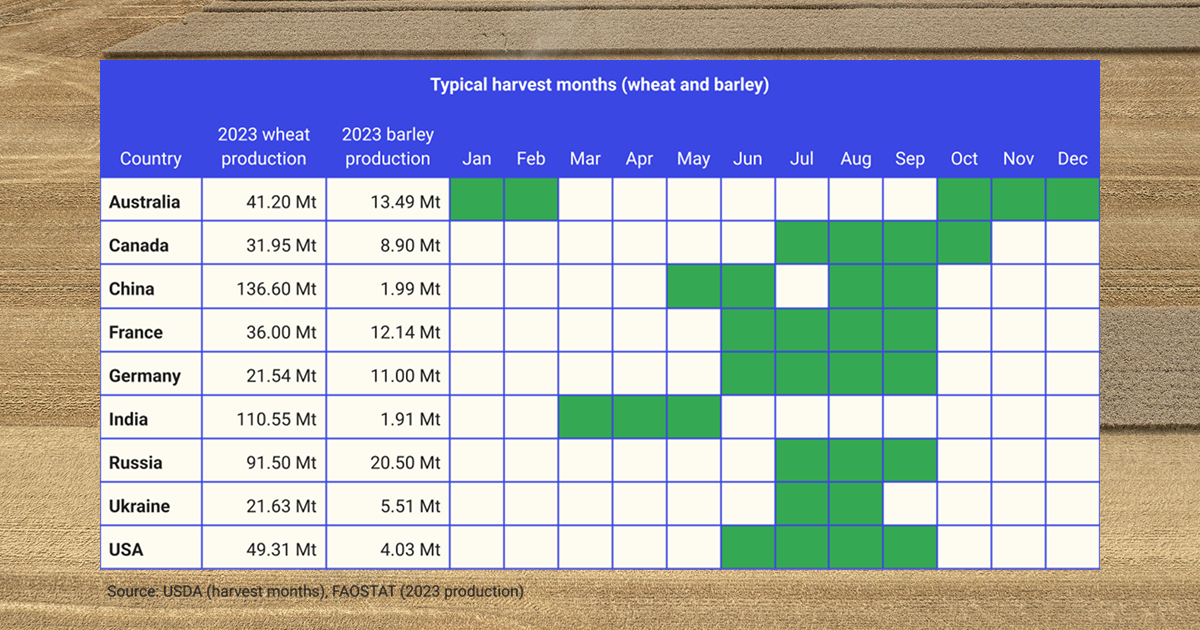

Typical global harvest months and production levels for wheat and barley

If major exporters like the US, China or Russia harvest early, large volumes hit the global market before UK grain is even in the shed. Equally, if those harvests are delayed or underperform, supply tightens – supporting prices here.

UK grain buyers watch international harvests closely, because overseas timing directly affects demand, imports and pricing power at home.

USA

The US typically harvests wheat and barley slightly earlier than the UK. The USDA reports that currently 53% of winter wheat has been harvested, compared to a five-year average of 54%.

The US also dominates the maize (corn) market, producing nearly 390 million tonnes in 2023. While the UK doesn’t grow much corn, it still matters, as the US maize harvest is a major driver of global grain pricing. And, as corn can be a substitute crop for animal feed, large US maize yields can put pressure on UK feed prices.

To keep up with the US harvest, look at the USDA’s regular Grain Stocks Report, Acreage Report and Crop Progress Report.

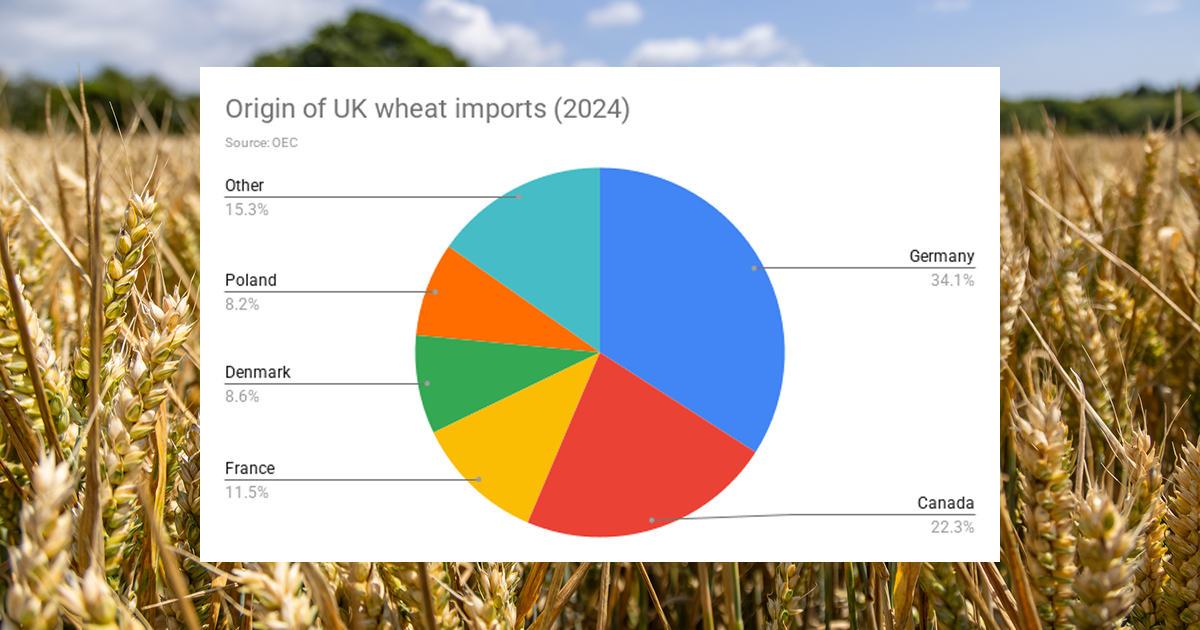

Origin countries of UK wheat imports in 2024

Europe

According to OEC data, France and Germany contribute over 45% of the UK’s wheat imports. When French and German crop yields are high, UK grain buyers can source cheap wheat from the continent. UK millers or feed compounders may then import more, especially if domestic prices are high.

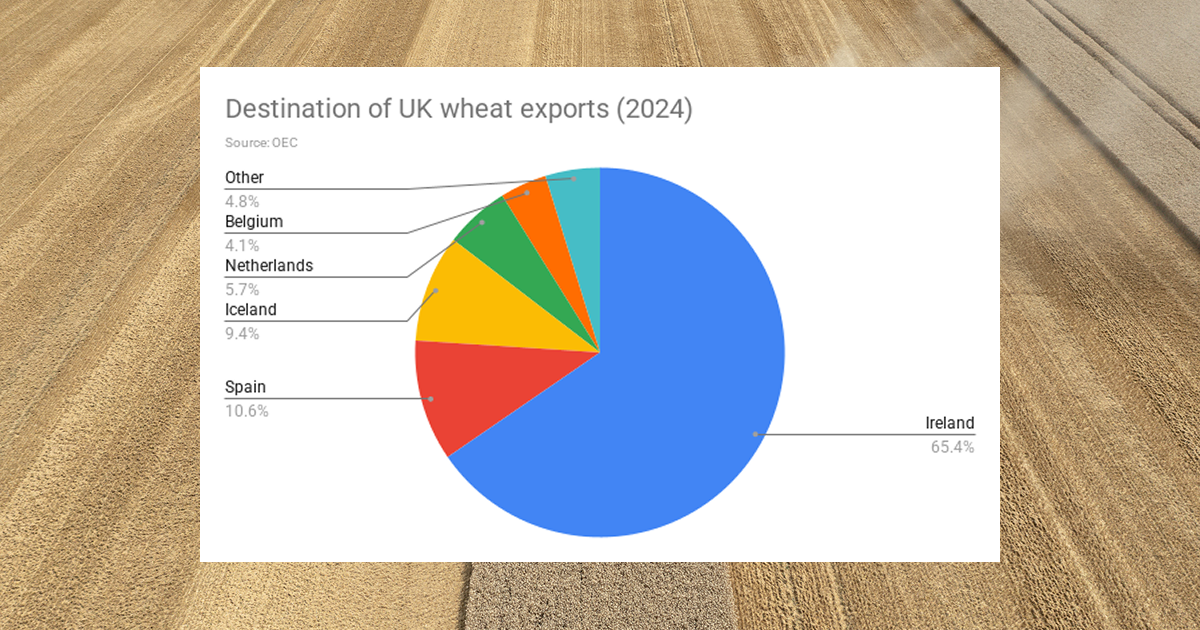

Europe is also the destination for nearly all UK wheat exports. If France and Germany have bumper harvests, cheap grain may flood the European market, making it hard for UK farmers to compete.

Destination countries for UK wheat exports in 2024

On the flip side, a poor continental harvest can make UK wheat more attractive for European buyers. This can push UK prices up, especially if domestic demand remains strong.

Ukraine

When Russia invaded Ukraine in February 2022, global wheat prices soared as the war disrupted supply chains, blocked ports and reduced planting. UK feed wheat futures shot past £300 per tonne to record highs.

The Black Sea Grain Initiative initially eased supply fears and prices fell back from peaks, but have remained volatile as the conflict continues, reacting to renewed attacks on Ukrainian infrastructure and Russia’s interference with grain export routes, along with seasonal harvest reports.

India

India is a major grain producer, harvesting over 110 million tonnes of wheat in 2023, mostly between March and May.

The UK-India trade deal, announced in May 2025, includes tariff cuts on UK whisky and gin from 150% to 75%, falling to 40% within a decade. As India is the world’s largest whisky market, this could indirectly drive demand for UK-grown malting barley, although the fineprint of the deal is yet to be scrutinised.

Australia

While Australia doesn’t usually sell much wheat directly to the UK, it can still influence UK prices.

If Australian wheat is cheap and abundant, it might undercut EU or Black Sea exports in Asia and the Middle East. This in turn can push more EU or Ukrainian wheat towards UK buyers.

The impact is most noticeable around December to March, when the Australian harvest is tailing off and hitting export markets. So while it’s not a direct link, the size and timing of Australia’s wheat crop definitely play into the bigger pricing picture.

Know your market, grow your margin

Global events are constantly shifting supply and demand for grain around the world, and the prices you achieve for your crop can be shaped by what’s happening in fields thousands of miles away.

By keeping tabs on global harvest progress, you can make more informed decisions about when and how to market your grain. In a connected world, local success starts with a global outlook.

Stay ahead of the market with Hectare Trading. Check out our pricing insights and post your own free crop listings.

This article is for general information only and is not an instruction to trade. While we make every effort to ensure the accuracy of the content at the time of publication, Hectare Trading makes no guarantee regarding the data provided.