Harvest 2025: why yield averages don’t tell the whole story

3-MINUTE READ

As harvest 2025 draws to a close, a clearer picture is emerging of the UK’s grain supply. Overall, production is up for wheat and oilseed rape compared with last year, but extreme yield variability is the standout story – and it’s placing some farms under real pressure while others are reporting bumper crops.

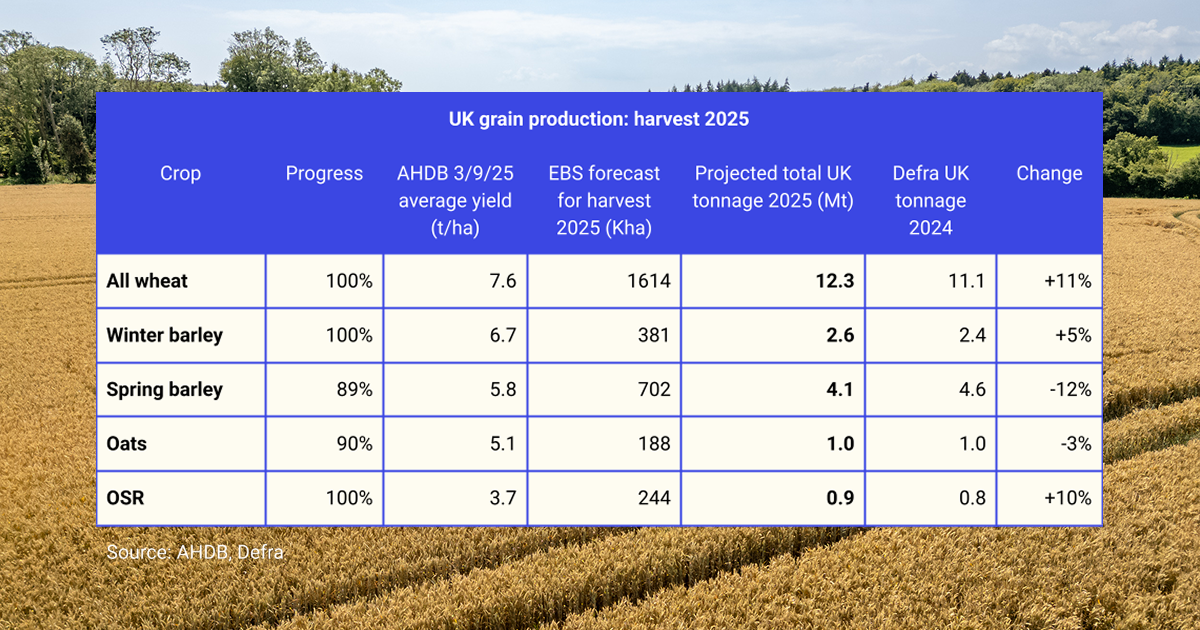

UK grain production snapshot

By combining the average yield estimates from AHDB’s latest Harvest Progress report with the 2025 planting intentions from their Early Bird Survey last November, we can build projections of overall grain production in the UK.

Our 2025 projections from AHDB and Defra data show increased production for wheat and OSR

Wheat

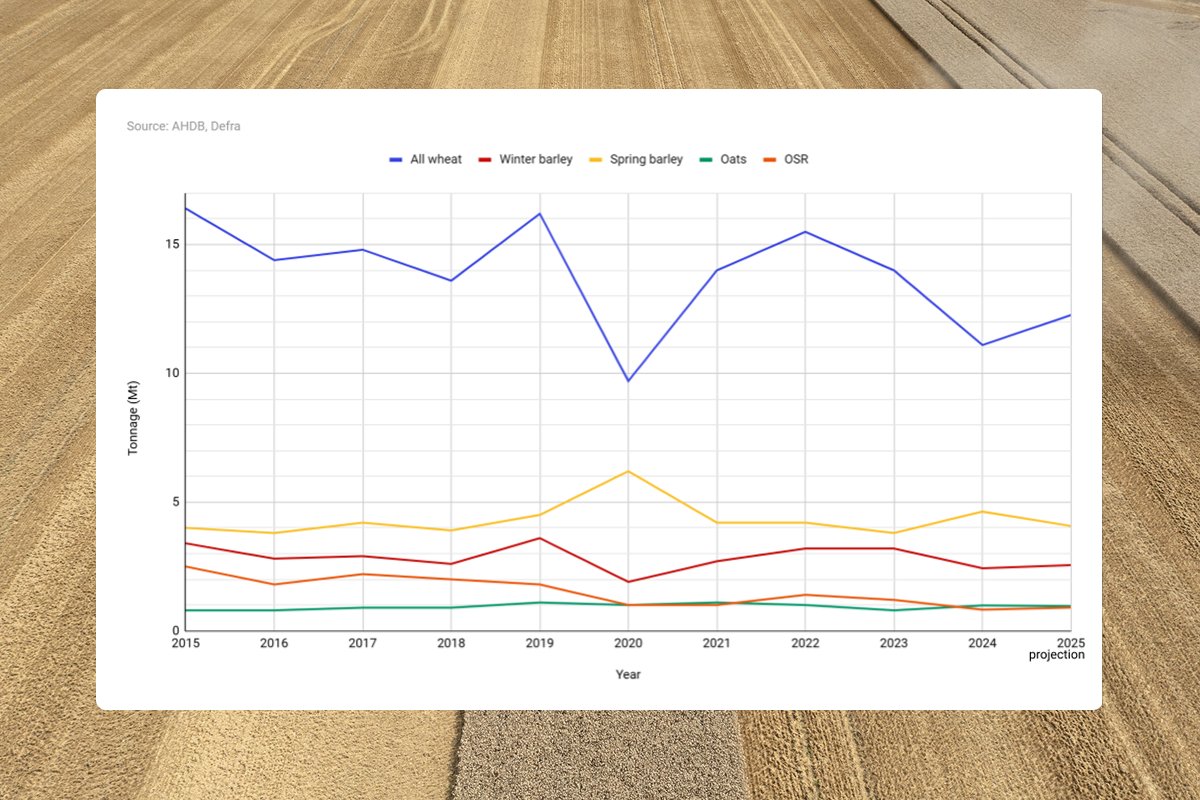

Output is set to rise by 11% to 12.3 Mt, compared to Defra’s figure for wheat production in 2024. While that’s an improvement on last year, it’s still below the tonnage recorded in eight of the last ten harvests.

While for individual farms an increased wheat yield can look positive, higher supply nationwide has the potential to weigh on prices, particularly as macroeconomic factors constrain demand for wheat, along with more specific events such as the closure of the Vivergo bioethanol plant.

Oilseed rape (OSR)

Production is up 10% on last year to 0.9 Mt, although the previous nine years all saw higher tonnages. Yields would likely have been higher if not for Storm Floris, which knocked seeds out of their pods, causing losses for farms not yet able to harvest their OSR, especially in Scotland and the North of England.

Barley

By contrast, spring barley production is down 12% at 4.1 Mt, only partly offset by a 5% rise in winter barley to 2.6 Mt. Concerns over high nitrogen in malting varieties mean restricted supply may push malting premiums up, while a consequent larger pool of feed barley could temper feed values.

Our 2025 projections compared to Defra production figures per crop since 2015

This year’s theme: variability

If one feature defines harvest 2025, it’s the extreme variability in yields, even between farms in the same region. We’ve seen this pattern clearly in our regular feedback from farmers around the country, and AHDB’s data confirms it.

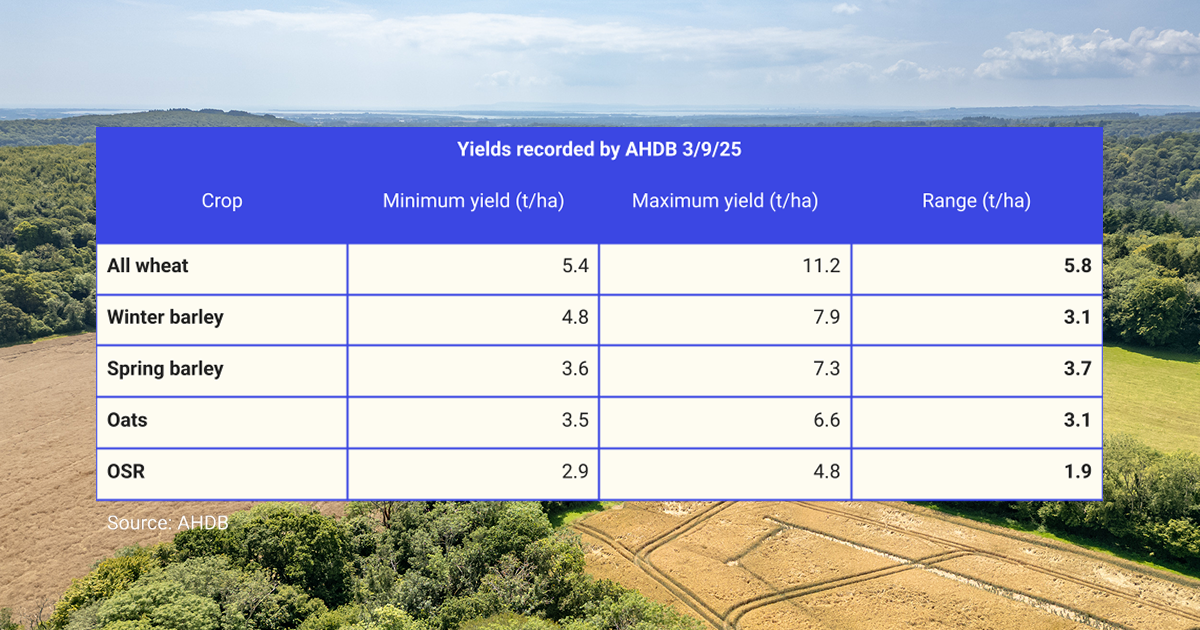

When we look at the minimum and maximum yields reported per crop, we see wide variation – and, according to AHDB, there are more farmers at these extremes this year.

Differences between the minimum and maximum yields recorded by AHDB per crop

The highest variation level is 5.8 t/ha for wheat. Based on our ex-farm spot price for feed wheat (Midlands & Wales) of £173/t, this represents a startling difference of £1,003.40 per hectare in the amount that UK farmers are making on wheat.

In response, UK wheat growers should be more flexible and strategic with their selling, not relying solely on national averages. The variability in supply means there may be regional pockets of demand for farmers who can respond quickly and be proactive in their grain marketing.

We’ve seen some record yields for OSR this year, but the overall picture is more mixed, with variation in yields of 1.94 t/ha reflecting the impact of Storm Floris. For next year, consideration of OSR varieties with enhanced pod shatter resistance could be important to protect against weather events.

However, for OSR, the story is more about planting than yields. As recently as 2018, the UK planted area for OSR was 583 Kha, while this year’s forecast was well under half that at 244 Kha. Improved yields for some OSR growers this year could encourage more planting for harvest 2026.

Reliable marketing in an unreliable year

The kind of variability we’ve seen this year underlines the importance of knowing your own cost of production and being flexible in your sales strategy.

For some, 2025 has been a year of record-breaking yields; for others, a reminder of how vulnerable crops remain to weather and local conditions.

In this environment, the most resilient farms will be those assessing regional demand as well as the national picture. That approach keeps the focus on profitability, not just production – helping farm businesses stay strong, whatever the next harvest brings.

Take charge of your grain marketing with Hectare Trading. Contact our expert team today and we’ll help you get started.

This article is for general information only and is not an instruction to trade. While we make every effort to ensure the accuracy of the content at the time of publication, Hectare Trading makes no guarantee regarding the data provided.