Manage your risk by selling little and often

2-MINUTE READ

You can’t control where grain prices are going to go, but you can control your own selling schedule. By selling smaller portions of your grain throughout the harvest year, you can manage your risk while keeping the flexibility to respond to market moves.

Trying to predict grain prices is notoriously difficult. Even if you have a good handle on harvest forecasts and expected yields, you can still be surprised by unexpected weather events or geopolitical turmoil affecting global demand.

How many times have you held out for a higher price only to accept a lower price later in the harvest year?

With a little-and-often strategy, instead of betting on a single price at a single moment, you’re building an average price over time – one that’s less exposed to sudden dips or short-term volatility.

Selling through the year

For example, you may follow a “thirds” strategy:

Forward-sell roughly one third of your grain before harvest, to lock in prices

Sell one third at harvest for immediate cash and to manage storage

Hold one third in store and monitor the market for post-harvest rallies

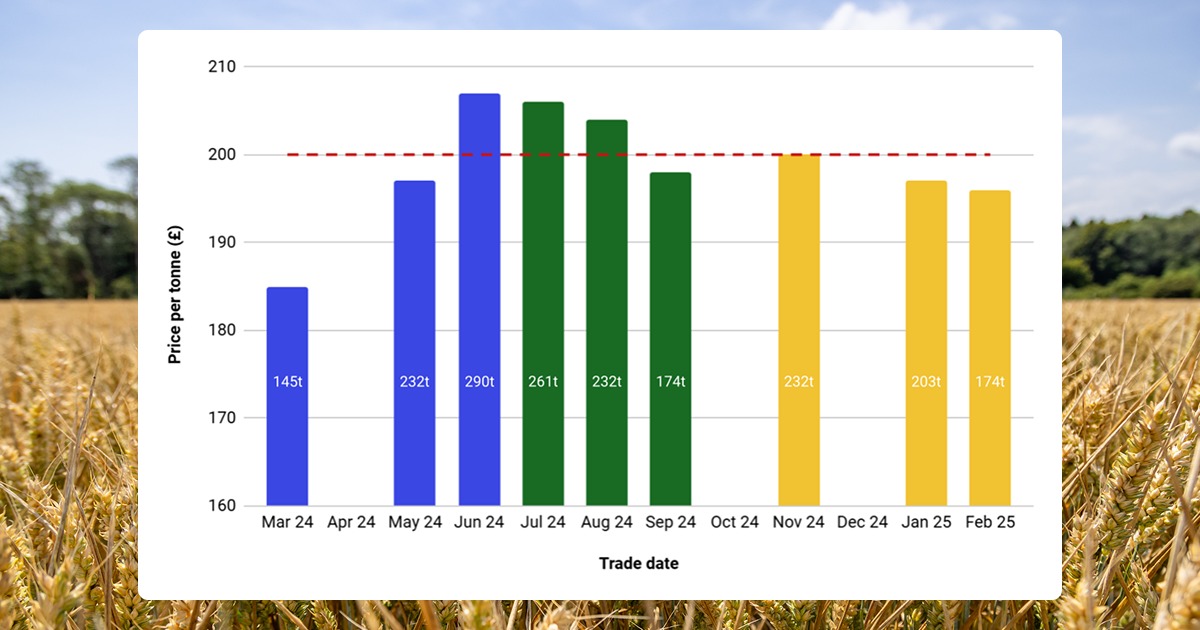

Selling in thirds: example of selling feed wheat pre-harvest, at harvest and post-harvest

The red line in the chart above shows your average selling price, weighted by the tonnage for each sale. This is your key measure of profitability.

Selling in stages means you’re never fully exposed to a sudden price fall. You’ve always locked in some value, and you’re always ready to respond.

This takes the emotion out of the decision-making. Instead of an all-or-nothing call, you’re making regular, smaller decisions, backed by the latest data – and that reduces stress.

You also have fewer regrets. It’s much easier to accept a missed price peak if you’re maintaining a solid average selling price throughout the year.

Little-and-often compared to grain pools

Grain pools offer the benefit of risk-sharing – but you lose flexibility and visibility. Selling little and often gives you a similar risk-managed average price outcome, with far greater control.

Regular smaller sales with Hectare Trading help you to build new relationships with a wider network of vetted and verified buyers, reducing your dependence on a few go-to merchants.

But what about the extra time and effort? With Hectare Trading you simply post a free crop listing whenever you’re ready to sell, then compare offers from our top buyers. If you don’t see an offer you like, there’s no obligation to sell.

You also get total price transparency. Your Hectare Trading account gives you free access to the latest ex-farm prices in your region, plus extensive market data and news. What’s more, you avoid a grain pool’s marketing fee which can be as much as £3 per tonne.

You decide when to sell, and you can still act on price spikes or local buyer demand – something you simply can’t do from inside a pool.

Respond to demand

Selling little and often doesn’t mean you’re stuck in a rigid plan. With Hectare Trading, you simply adjust your schedule whenever the market moves – pausing, speeding up or responding to a seasonal price peak.

You can also adjust your tonnage for each sale, offering more grain when demand is high in your region or to clear storage.

Managing grain sales is a challenge, especially when farming is already more than a full-time job. By selling little and often, you’re spreading your risk, keeping your options open and making grain marketing a little less stressful.

Open a free account with Hectare Trading and see whether a little-and-often strategy might work for you.

Not sure where to start? Book a chat and we’ll guide you through the Hectare Trading site and help you post your first crop.