How to lock in value before your seed is in the ground

3-MINUTE READ

Prices might feel a long way off when you’re planning next year’s crop, but it’s never too early to lock in value and control your risk. Forward-selling isn’t just for harvest-ready grain – it’s a year-round tool for strategic grain marketing.

Thanks to the dry spell, it’s been an early drilling season for many – at least until Storm Amy hit. But have you considered that you can sell your grain before you even get the seed drill out of the shed?

By selling for movement in harvest 2026, you can take some of the uncertainty out of next year’s marketing. You’re effectively managing your risk by fixing part of your future income.

Take advantage of the carry

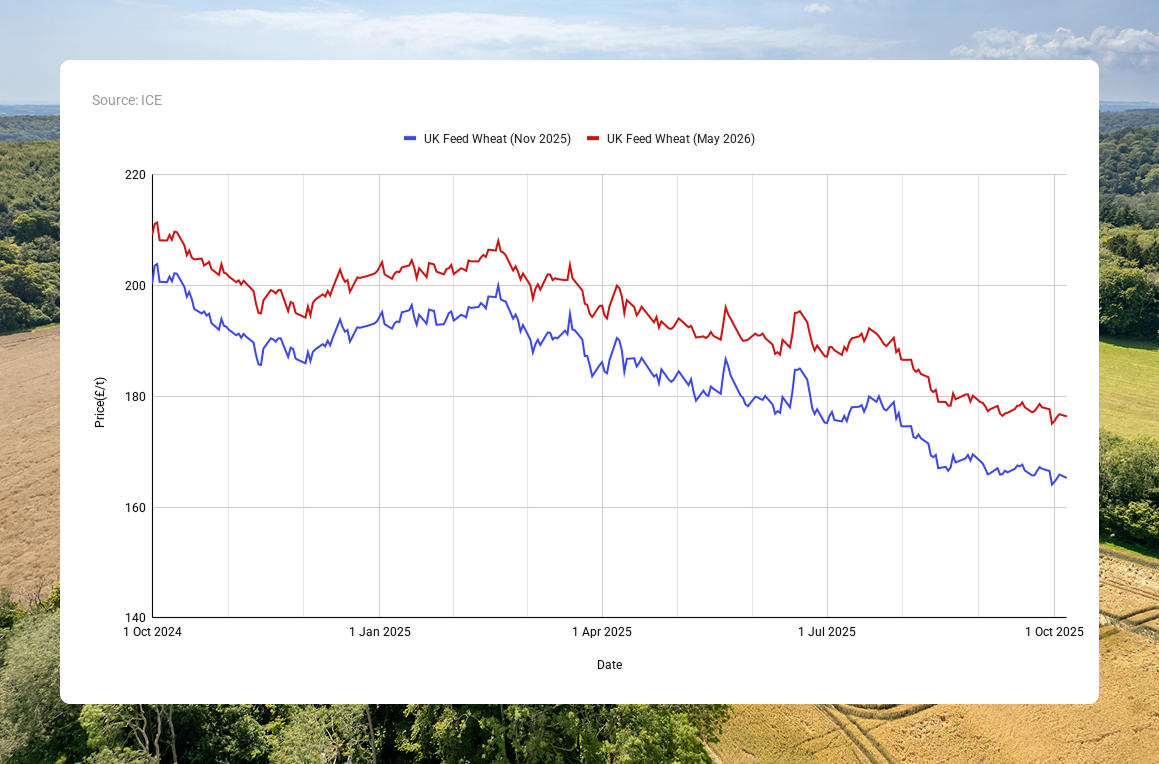

Grain merchants typically base forward prices on the futures market. On 6 October, the November 2025 UK (ICE) Feed Wheat contract closed at £165.25/t, while the May 2026 contract was at £176.35/t.

That’s a difference of £11.10 per tonne. Or £1.85 for every month further forward.

If we track the performance of the November 2025 and May 2026 contracts side by side, you can see the consistent carry (the increase in value for future delivery) over the past year.

Futures markets give you an indication of the carry (extra value) you can get for future delivery

In other words, the market’s paying you a premium to sell your grain now for future delivery.

Of course, for old crop you would factor in the cost of storage to see whether this premium is beneficial to you. But when you’re selling next year’s grain for future delivery, naturally there’s no storage cost while the crop is still in the ground!

Selling forward on Hectare Trading

Simply list your grain and select “2026” as your harvest year. You can then select which months you want to move your crop, or “as available at harvest” if you want to sell it straight off the combine.

Buyers will see that you’re selling for movement in 2026 and price accordingly. Set the time you want to review your offers – you’ll have half an hour to accept any price you receive.

If you grow premium crops, you can use a feed base plus premium contract. This locks in a fixed feed price now with a potential premium once your quality spec is known.

Test the market – with no obligation

Of course, the futures market only gives you an indication of possible forward prices, and not every crop has a relevant futures contract. You should also consider regional factors that can affect future demand.

That’s why many farmers use Hectare Trading to test the market. This can be more reliable than asking a grain merchant for a forward price as you’re seeing prices from a range of buyers competing with each other.

Simply post a listing for harvest 2026 and see what offers come in. You’re under no obligation to accept any price. It’s a quick and easy way to take the temperature of the market for future movement.

Flexible selling through the year

Another option is to wait until the crop’s established before selling forward. You may potentially lose some value by holding on, but you can be more confident of delivery. A lot depends on your cashflow and your attitude to risk.

No one is telling you to forward-sell all your crop in one go, but the earlier you start selling portions of your new crop, the sooner you can lock in a price – and potentially some carry. By selling little and often through the year, you can manage your profitability and respond to market changes.

You may choose to sell some before drilling, some once the crop’s established and some later in the year. With Hectare Trading, you’re always in charge. Just enter your minimum and maximum tonnage for each listing and trade on your own terms.

Selling forward helps you lock in profit, reduce risk and make the most of the carry, all while keeping the flexibility you need throughout the year. You don’t have to stay at the mercy of the market – with forward-selling, you can take control.

Are you ready to see prices for harvest 2026? Post a free listing today to see what buyers are willing to pay to secure your 2026 crop.

This article is for general information only and is not an instruction to trade. While we make every effort to ensure the accuracy of the content at the time of publication, Hectare Trading makes no guarantee regarding the data provided.